FEATURED ARTICLE

Let's fight £10 billion in bank fees!

Edoardo Moreni

July 25, 2018 •2 min read

TABLE OF CONTENTS

Our findings

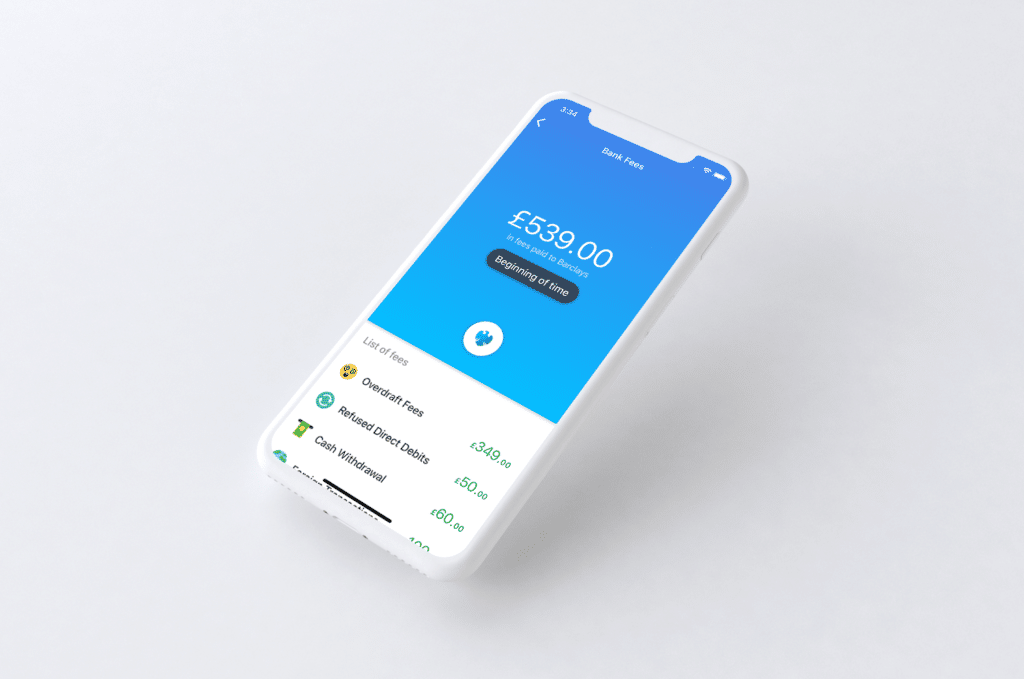

Today, we are introducing our Fee Tracker.

For the first time, in personal finance, consumers will be able to see exactly when and why big banks have charged them. With the aim to empower you to make better and smarter decisions when it comes down to money.

The tracker lets consumers hunt down senseless bank fees and helps them compare banks with each other. Do you want to know which of your banks is ripping you off the most? We are the only ones to have the answer.

Every existing Emma user can now access our tracker from the mobile app, both available on Android and iOS. This comes as part of our latest update, which was released this morning! 🙌

Our findings

We have spent the past few weeks analysing millions of transactions with our data scientists and have developed a technology that brings transparency and clarity in people's lives.

When we first started this we didn't know what we were going to face. Our early results showed right a away an average of £170 a year just for overdraft fees. In a country where more than 2 million people live in permanent overdraft, something had to be done.

Our cutting edge research has identified 7 different types of fees.

- Overdrafts

- Fixed Accounts

- Foreign transactions

- Refused direct debits

- Cash withdrawals

- Bank transfers

- Late payments

On top of these, we have also tracked down several other fees that still remain uncategorised.

The results are clear. Overdrafts are leading the way and take up more than 60% of the overall fees. These are followed by fixed accounts fees, which happen on a monthly basis, and have 30% of the share, while foreign transactions get 10% of the market.

With charges up to 3% non sterling transactions are generating a billion pounds market, without making consumers aware. Most of these charges are included within the transactions, so it becomes really difficult to track them down; but our technology is able to extrapolate the exact amount from the bank data. 😉

Alongside these three main categories, we have other types such as late payments and refused direct debits, with charges up to £5!

This is one of the many efforts we are making to tackle down an industry that has been unclear, shady and dodgy for more than 800 years. We are super thrilled to announce this new feature and let you know that the fight has just started, but the best is yet to come. 😎

The world where financial institutions take advantage of their customers is about to end and you can be part of this. Join our fight and help us say no to bank fees!

You may also like

Check out these related blog posts for more tips

© 2026 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.