FEATURED ARTICLE

Unlocking Your Investment Potential: Introducing Emma's New 'Buy in Shares' Feature

Giuliano Fabbri

June 24, 2025 •4 min read

TABLE OF CONTENTS

What's New? More Ways to Buy and Sell Shares

New options to sell and manage your investments

Build Wealth Over Time: Automatic Dividend Reinvestment

Why Invest with Emma? Key Benefits for UK Investors

Take Control of Your Financial Future Today!

Ever felt that investing in the stock market was too complex, too expensive, or just not for you? Many people in the UK want to make their money work harder, but the traditional routes can seem daunting.

At Emma we've been on a mission to simplify your financial life. We help you track spending, set budgets, and gain clarity over your finances. Now, we're taking that mission a step further by making investing more accessible and flexible than ever before.

We're thrilled to introduce a suite of powerful new trading features within Emma Invest – designed to empower everyone in the UK to participate in the stock market, regardless of their starting capital. It's time to democratise investing and help you build a brighter financial future with more control and precision.

What's New? More Ways to Buy and Sell Shares

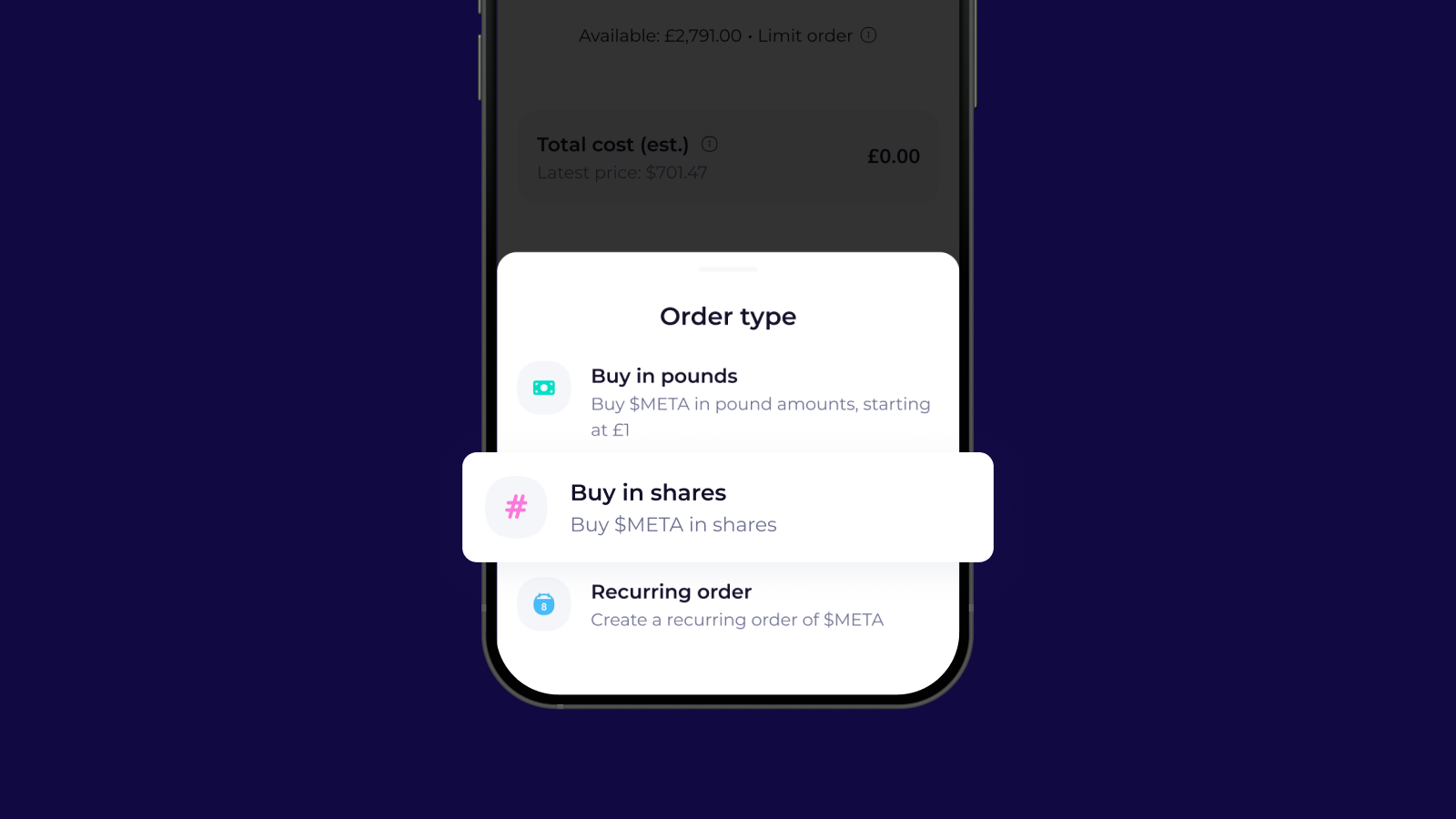

The core idea of 'Buy in Shares' remains simple yet powerful: buying portions of publicly traded companies directly through your Emma app. Think of it as your gateway to owning a piece of the world's most innovative and well-known businesses. But now, we've added even more flexibility:

1. Buy in £ or Shares:

Whether you prefer to invest a specific amount of money (e.g., £100) or buy a precise number of shares (e.g., 5 shares), Emma gives you the choice. This flexibility allows you to tailor your investment strategy precisely to your goals.

2. Demystifying Fractional Shares

A common barrier to investing is the high price of a single share in some popular companies. That's where fractional shares come in. With Emma, you don't need to buy a whole share. You can invest as little as £1, owning just a fraction of a company. This makes high-value US stocks attainable and allows you to diversify your portfolio much more easily, even with a smaller budget.

3. Recurring Buy in £

Take the effort out of consistent investing with our Recurring Buy in £ feature. Set up automatic, regular investments of a fixed amount into your chosen stocks. This is a powerful way to implement pound-cost averaging, reducing the impact of market volatility and building your portfolio steadily over time without needing to constantly monitor the markets.

New options to sell and manage your investments

But it's not just about buying. We've also enhanced how you can sell and manage your investments:

1. Sell in Shares

Just as easily as you buy, you can now sell your holdings by specifying the number of shares you wish to sell.

2. Limit Sell

Take control over your selling price. A Limit Sell order allows you to set a minimum price at which you're willing to sell your shares. Your order will only execute if the stock reaches that price or higher, protecting you from selling at an undesirably low price.

3. Stop Sell

Protect your gains or limit potential losses with a Stop Sell order. This order converts to a market sell order once your specified "stop price" is reached. It's a key tool for risk management, ensuring your shares are sold if the price drops below a certain point.

4. Limit Buy

Similar to a Limit Sell, a Limit Buy order lets you specify the maximum price you're willing to pay for a stock. Your order will only execute if the stock's price falls to that level or lower, ensuring you don't overpay.

Build Wealth Over Time: Automatic Dividend Reinvestment

We're constantly working to give you more tools to maximise your wealth. That's why, in addition to these flexible trading options, we recently launched automatic dividend reinvestment for Emma Invest!

Instead of receiving cash payouts from your eligible dividends, you can now choose to automatically reinvest them into additional shares of the same investment. This is a powerful way to harness the magic of compounding, allowing your portfolio to grow passively and accelerate your wealth over time without any extra effort on your part. It's investing on autopilot!

Why Invest with Emma? Key Benefits for UK Investors

We've built these features with you in mind, focusing on simplicity, transparency, and accessibility. Here’s why Emma Invest stands out:

- Accessibility for All:

- Invest from Just £1: Our low minimum investment breaks down barriers, making investing possible for everyone.

- Fractional Shares: Diversify into a wider range of US stocks, regardless of their individual share price.

- Precision & Control: New order types like Limit Buy, Limit Sell, and Stop Sell give you more strategic control over your trades, allowing you to execute at your desired price points and manage risk effectively.

- Simplicity & Convenience:

- All-in-One Financial Hub: Manage your spending, saving, budgeting, and now, sophisticated investing, all within one intuitive Emma app. No more juggling multiple platforms!

- User-Friendly Interface: Designed for clarity, making the investing process straightforward even for beginners, while offering powerful tools for more experienced users.

- Transparent & Low-Cost Investing:

- Commission-Free Trading: That’s right – we don't charge any commission on your stock buy and sell orders. This means more of your money goes directly into your investments.

- Clear FX Fees: When you buy or sell US stocks, a transparent FX (Foreign Exchange) fee applies as your GBP is converted to USD. This fee varies by your Emma subscription plan (Free: 0.99%, Plus: 0.45%, Pro: 0.20%, Ultimate: 0.12%). You’ll always see this clearly displayed before you confirm your trade.

- No Hidden Charges: No account opening fees, custody fees, or transfer fees when depositing or withdrawing funds.

Important Investment Disclaimer: Your Capital is at Risk.

Remember, investing involves risk. The value of investments can go down as well as up, and you may get back less than you invested. Past performance is not an indicator of future results. Please ensure you fully understand the risks involved before investing. Consider seeking independent financial advice if you are unsure.

Take Control of Your Financial Future Today!

The world of investing no longer needs to be intimidating. With Emma Invest's flexible 'Buy in Shares' options (including buying by £ or shares, recurring buys, Limit Buy) and advanced selling tools (Sell in Shares, Limit Sell, Stop Sell), combined with automatic dividend reinvestment, we’re making it simpler, more precise, and transparent for everyone in the UK. Start building a diversified portfolio, make your money work harder, and unlock your investment potential.

You may also like

Check out these related blog posts for more tips

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.