FEATURED ARTICLE

Your Money, Your Rules: Introducing Flexible Monthly Autosaves

Giuliano Fabbri

August 21, 2025 •2 min read

TABLE OF CONTENTS

A Smarter Way to Save, Your Way

Your Savings, Your Goals

Have you ever felt like your budget just doesn't quite click with your payday? For many, the desire to save is strong, but having money automatically transferred weekly can sometimes disrupt cash-flow, especially when all your big bills hit at the end of the month.

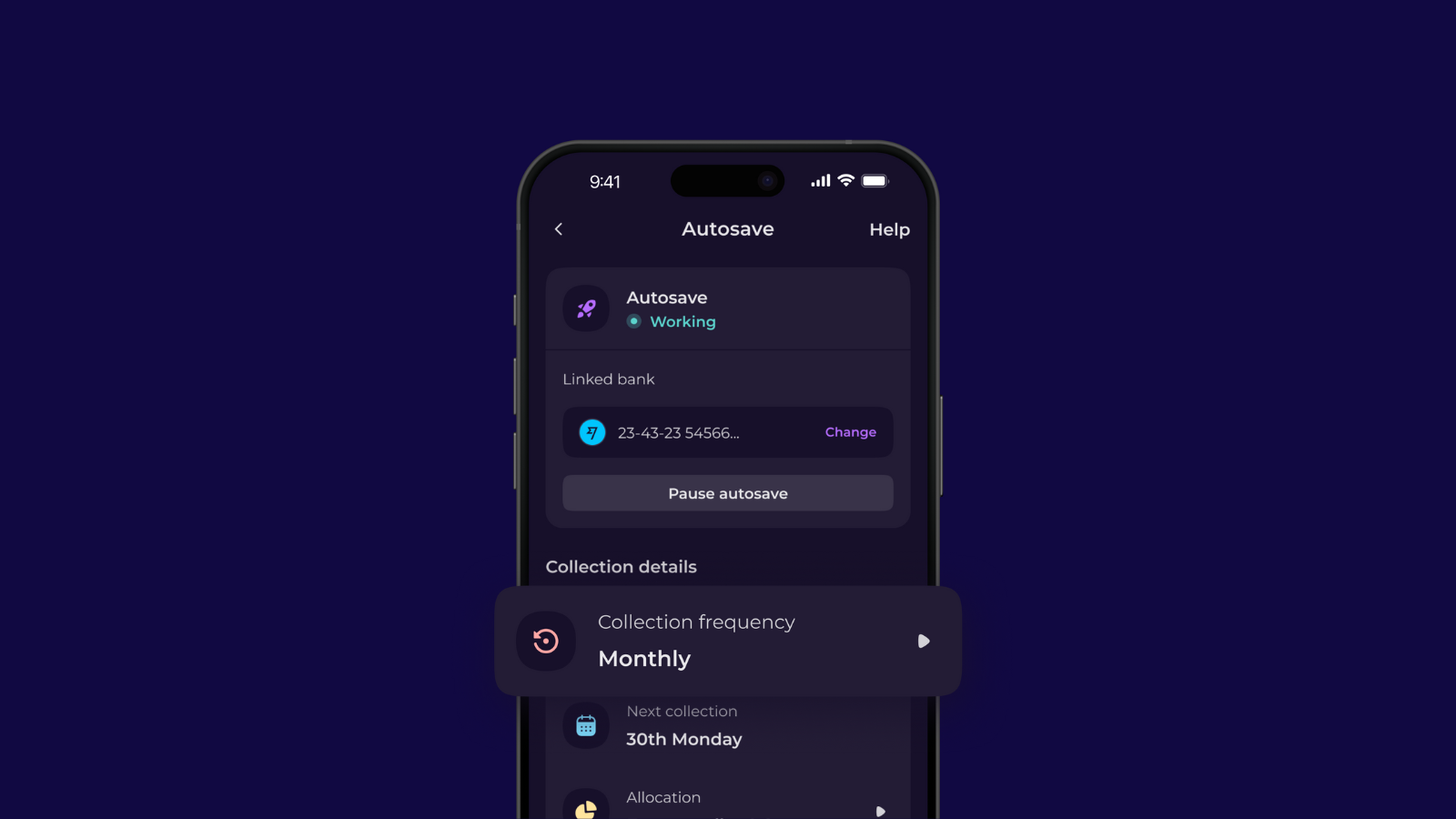

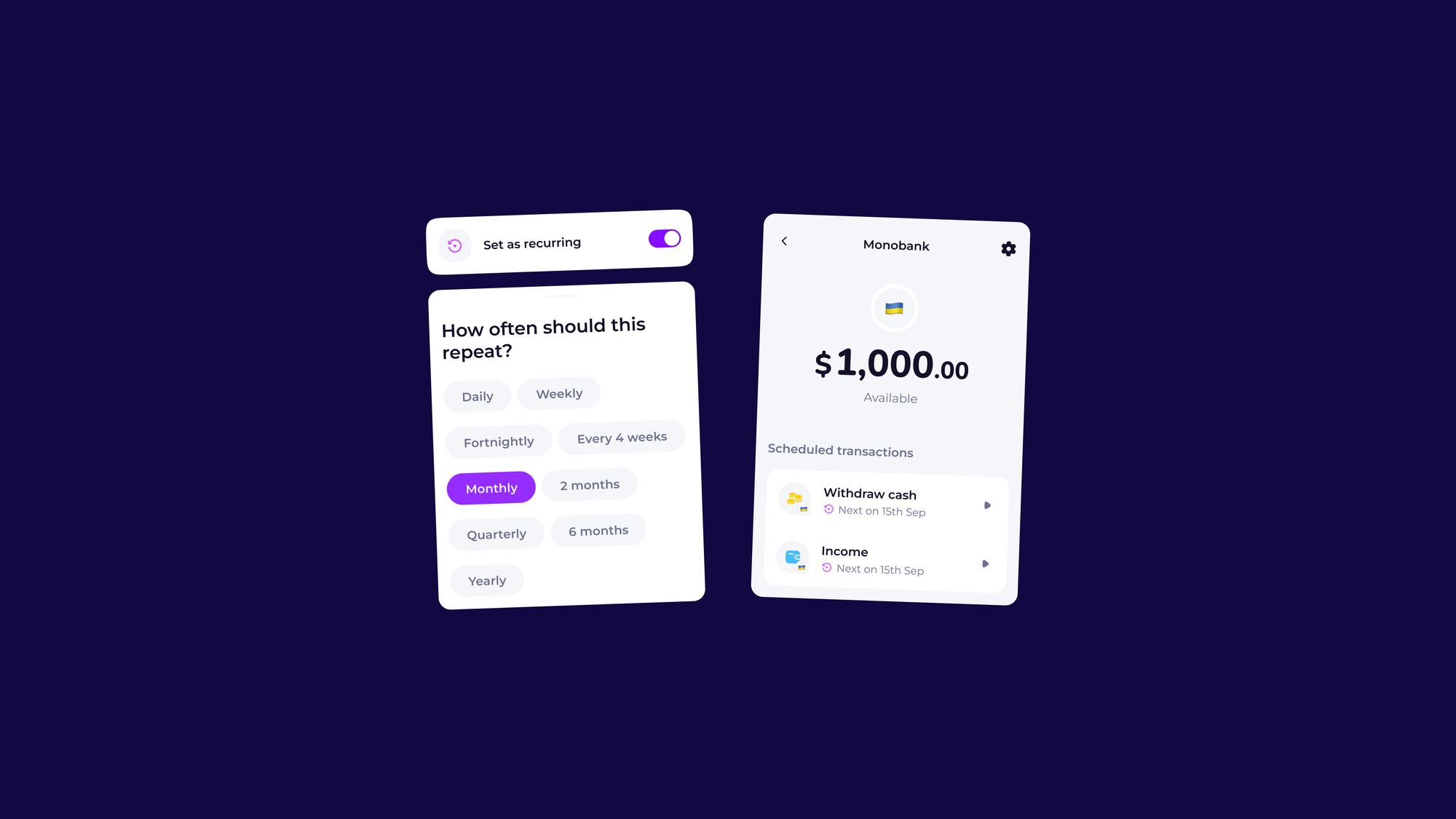

We heard you! That's why we're thrilled to announce a new feature for your budgeting app's Autosave function. Now, you have the power to choose between weekly and monthly transfers. While we previously saved weekly to make the most of your interest, we've updated the system so your savings can be calculated weekly, but you can choose to have them all transferred in one lump sum at the end of the month. This simple yet powerful change gives you back control and helps you maintain a better cash flow in line with your payday.

A Smarter Way to Save, Your Way

Autosave is all about making saving effortless. The idea is to squirrel away money without even thinking about it, turning good financial habits into a seamless part of your life. And you have multiple ways to make this happen:

- Round-ups: This popular method rounds up your spare change from every purchase to the nearest pound. You can also multiply your round-ups by 2x, 3x, or more to accelerate your savings.

- Fixed Amount: Want to save a specific amount each week or month? This option allows you to set a recurring fixed amount to consistently grow your pot.

- AI Save: For those who want to be hands-off, AI Save uses intelligent algorithms to analyse your spending habits and find the perfect amount to save each week or month without disrupting your budget.

The best part? You can use any of these methods individually or combine them all for a super-charged saving experience.

Your Savings, Your Goals

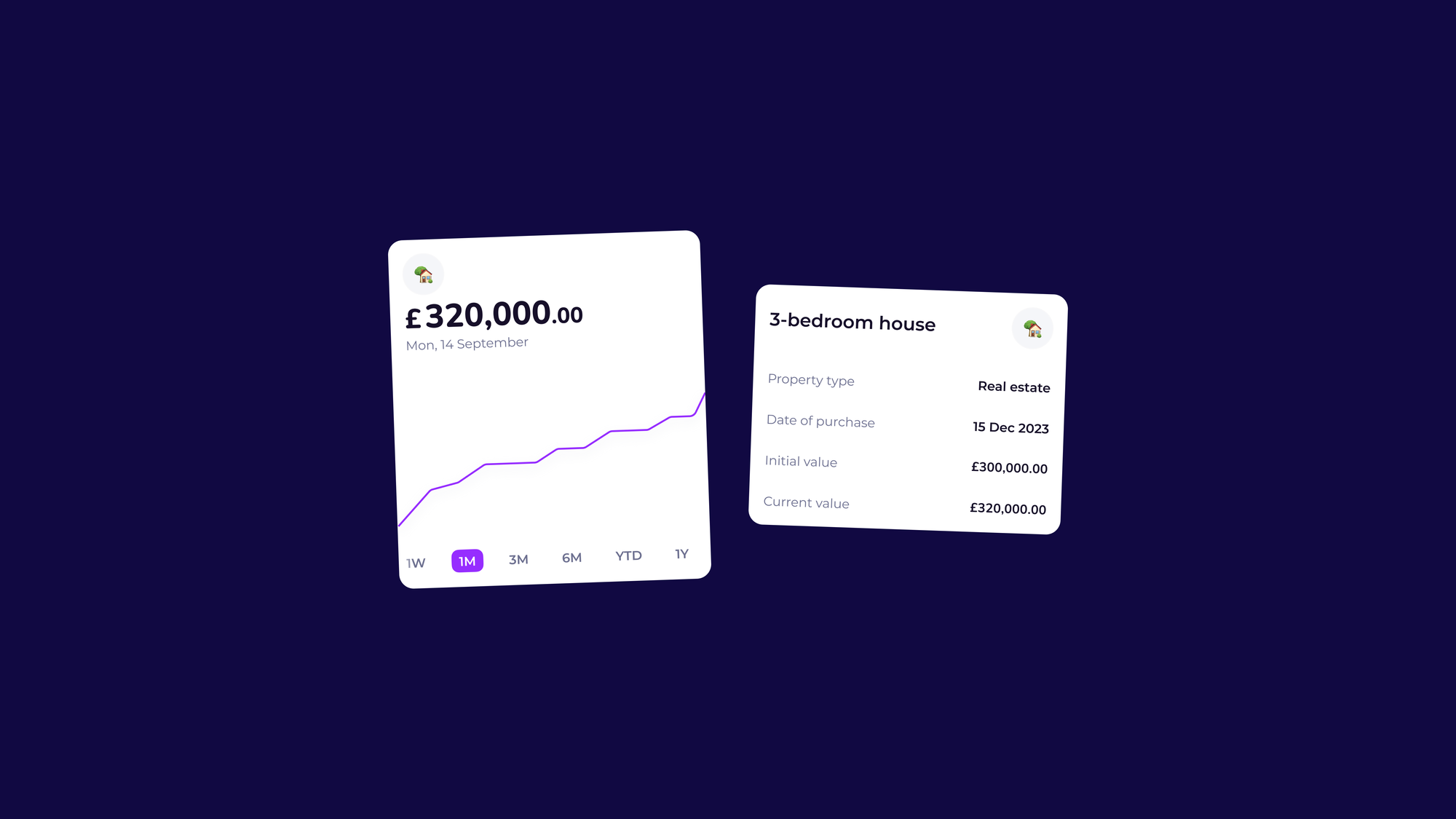

All the money you save with Autosave goes into your Saving Pot. Think of these as dedicated digital envelopes for your financial goals. Whether you’re saving for a holiday, a car, or a down payment on a house, having a separate pot makes it easy to track your progress and stay motivated.

Learn more about Saving Pots and how they can help you reach your goals!

The ultimate goal of budgeting isn't about restriction; it’s about empowerment. By automating your savings and giving yourself a clear view of your financial health, you're not just saving money - you're building a foundation for a future where you can achieve all your goals, big or small.

You may also like

Check out these related blog posts for more tips

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.