FEATURED ARTICLE

How Budgeting Works in Emma

Edoardo Moreni

November 24, 2019 •3 min read

If you are looking to budget in a super friendly and easy way without needing spreadsheets, calculators or lots of manual work, Emma is the answer to you.

This is the #1 budgeting app in the world and is currently available across the US, Canada and UK.

At Emma, we have taken a lot of time to think about what the best way to budget is and we have implemented our own budgeting system that will make your life super super easy.

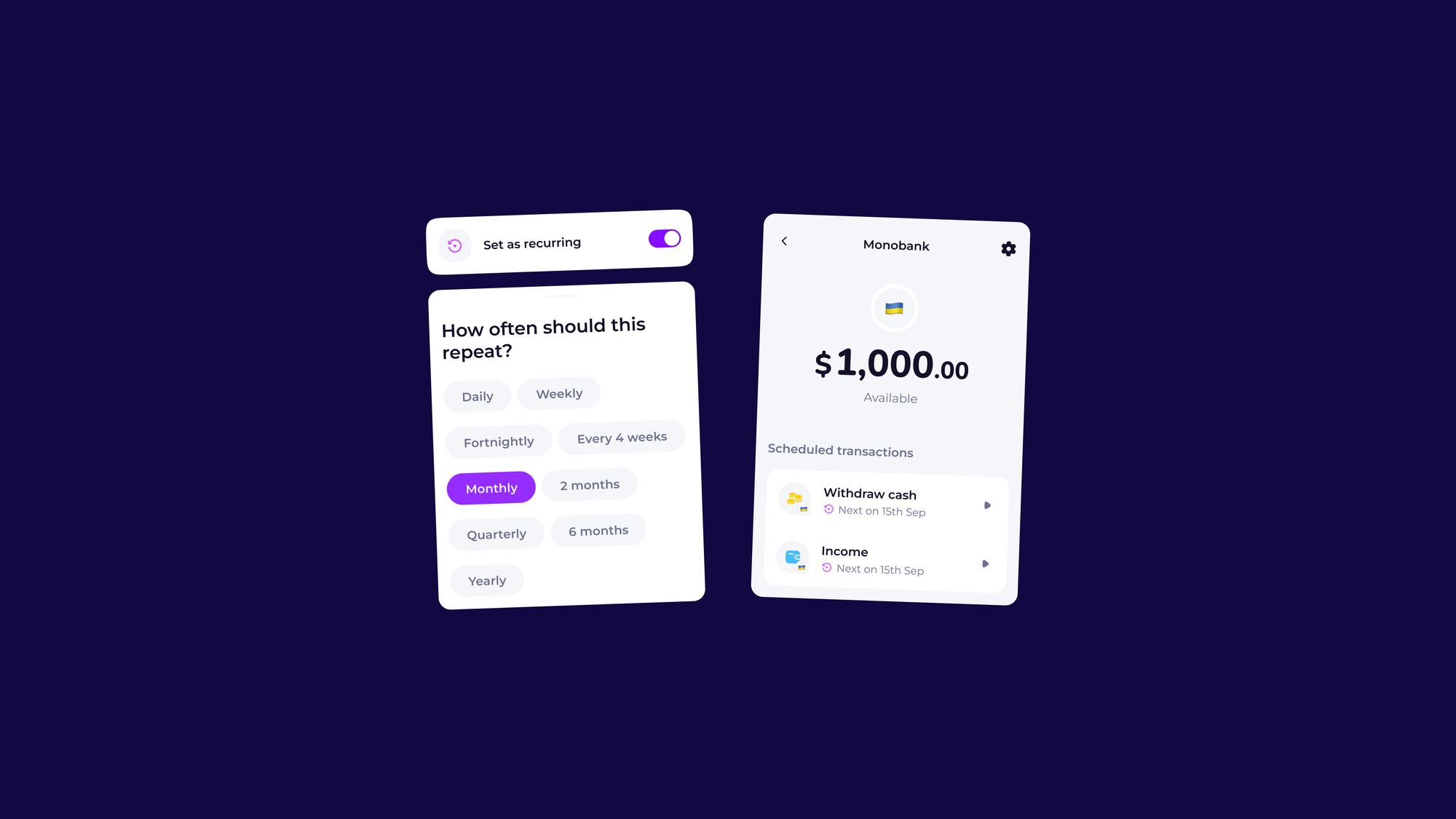

#1 - Choose a Budgeting Period

The first step to setup budgeting in Emma is to choose a period. We currently support two modes: payday to payday or monthly budget.

The first one is very suitable for those of us who get a salary from one employer. This can be on a fixed date, every month, twice a month, every four weeks, two weeks or one week.

There are a variety of paydays supported, including last working day of the month, which is what I have set. The goal here is to setup a budget that we can track payday to payday.

The second mode will set up a budget that starts on the 1st of the month and ends on the last day.

This mode is suitable for those who have different incomes from multiple employers, freelancers or people who generally don't have a fixed income, such as students.

Budgeting payday to payday is very useful to keep your bills and recurring payments in control; but again, if you don't like this, the second option works in a very similar way.

#2 - Set a Total Budget

The Total Budget will be the amount of money you are allocating to spend within the budgeting period selected. For example, in my case, I get paid on the last working day of the month. The total budget is what I am planning to spend, including bills.

In this way, what I am saving in this budgeting period is my income minus the total budget I have set - if I don't spend more than that. Savings shouldn't be a target, but a result of what we do within the period. If we follow the target and don't go over it, we are saving cash.

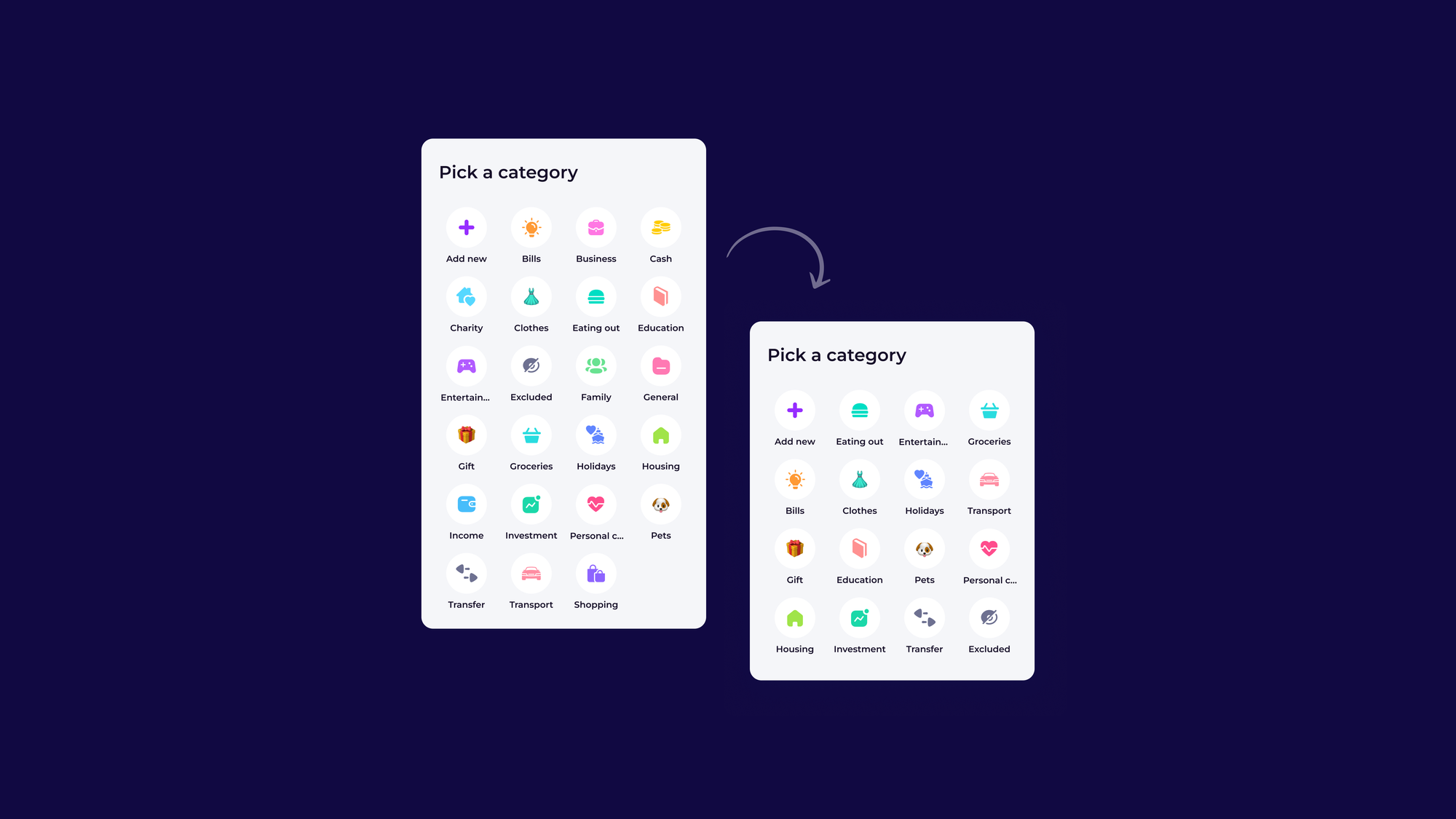

#3 - Set individual budget categories

The total budget can be broken down in individual budget categories. This feature can be very useful to those who want to better track their spending to a much more granular level.

Emma will also adjust the total budget, if the sum of all individual budgets go over what you have previously set.

I usually prefer to have a clear total budget and then 3-5 budget categories to track across the period.

As you might have noticed, my total budget is way greater than the income I have selected. If this was the case, it would mean always spending more than what we make.

In my case, I am sharing a flat with another person. This means all the bills, including rent, go through my account; so I have increased my total budget to match that. I am going to get half of that spending back, so my "real budget" is around £1400s.

As you can see, setting up budgeting in Emma is very straightforward. The app will also notify of every change and progress you are making with the total budget and each individual category. If you are going too fast or are on track, Emma will tell you! :)

You may also like

Check out these related blog posts for more tips

© 2026 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.