FEATURED ARTICLE

Emma launches closed beta

Edoardo Moreni

December 4, 2017 •1 min read

December, 2017 – London-based Emma Technologies LTD has started rolling out invites to join its closed beta. After successfully releasing Emma, an app for Android and iOS, the company has given priority access to the thousands of users who signed up on the website.

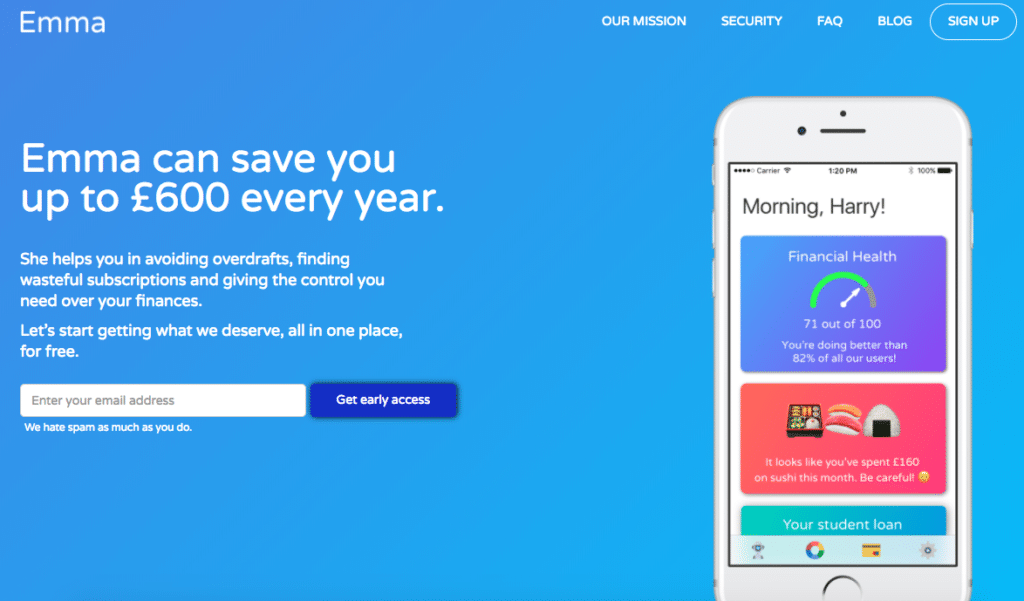

Emma is a mobile only solution that helps consumers avoid overdrafts, find and cancel subscriptions, track debt and save money. The app can save up to £600 a year by solving these four problems. The product aims at providing a consumer focused banking experience, with the only aim to improve the financial situation of its users.

In the past years, managing money has become extremely difficult. People tend to have multiple accounts, several contracts, different credit cards and the challenges of having everything under control keep growing. Emma wants to put an end to this. Money management should be easy and straightforward. Consumers should be able to access all the information regarding their personal finance from the push of a button.

Emma is here to solve this problem and try to give customers a different banking experience, which puts them first, not their money or background. The company believes anyone should have an advocate that is able to help in the daily life, no matter who they are and where they come from.

“We started developing Emma on a mission to improve people's financial well being. We are thrilled to on board the thousands who signed up to our wait list. We believe people deserve a private wealth manager that only serves their interests and is able to improve their finances. Open Banking will enable Emma to disrupt the personal finance industry and help consumers save more money.” – Edoardo Moreni, CEO and Co-founder of Emma Technologies LTD.

Facebook: https://www.facebook.com/emmafinance

Twitter: https://twitter.com/emma_finance

Instagram: https://www.instagram.com/emma_finance

You may also like

Check out these related blog posts for more tips

© 2026 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.