FEATURED ARTICLE

NEW: Emma Pots & Wallets Now Available Across All Your Spaces!

Giuliano Fabbri

May 27, 2025 •2 min read

TABLE OF CONTENTS

Wait… What Are Emma Spaces?

Smart Saving Options in Emma

Which Pot Fits Your Goal?

Why This Matters

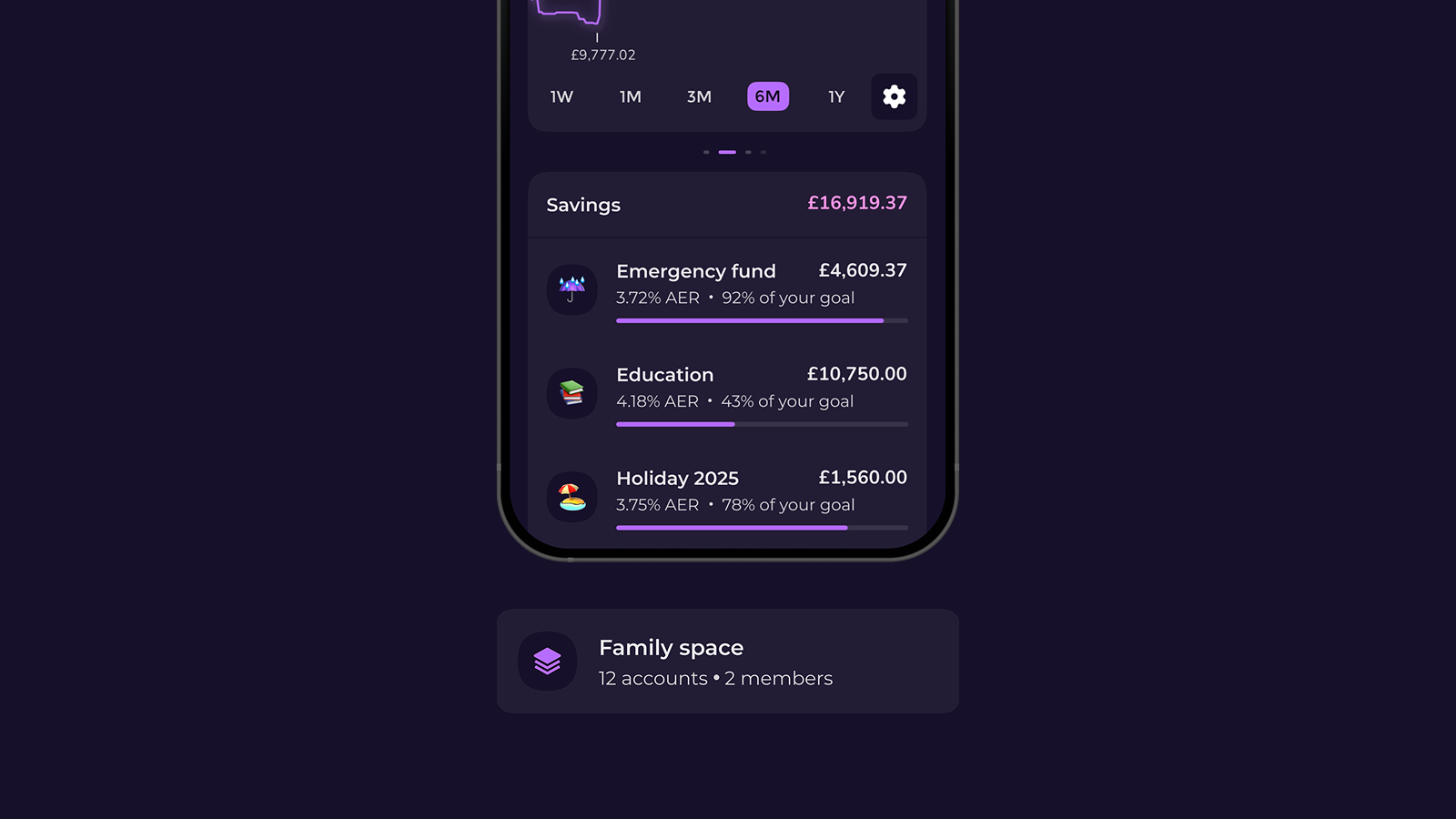

Big news for Emma Ultimate users: You can now create saving pots and wallets in any Space - not just your primary account.

That means - organised savings for every part of your life.

Wait… What Are Emma Spaces?

Spaces is an Emma Ultimate feature that let you group accounts to match your real-world money flow. Think of them as folders for your financial life.

Key Features:

- Separate budgets & analytics per Space (no more mixing personal/work spending)

- Private or shared (invite partners, family, or financial advisors)

- Shared Pro features (invitees get access to premium tools in that Space)

Example uses:

- Couples: Joint Space for household bills + private Spaces for personal spending

- Freelancers: Client income in one Space, personal finances in another

- Parents: Kid’s allowance tracker in Family Space

Smart Saving Options in Emma

Now that you can create pots in any Space, let’s break down the three ways to grow your savings - automatically or manually.

1. Round-Ups: Save Without Thinking

🔄 How it works: Emma rounds up every transaction to the nearest £1 and saves the difference.

Example:

- Spend £3.40 on coffee → 60p goes to your chosen pot

- Do this 10x/week → £6 saved effortlessly

✅ Best for:

- Building emergency funds slowly

- People who forget to save

2. AI Saving: Let Emma Do the Math

🤖 How it works: Our algorithm analyzes your income/spending and auto-saves safe amounts (e.g., £20 every Friday).

Example:

- If you consistently have £100 leftover before payday → Emma saves £30-50 automatically

✅ Best for:

- Variable incomes (freelancers, shift workers)

- Hands-off savers

3. Custom Deposits: Full Control

🎯 How it works: Manually transfer any amount whenever you want.

Pro tips:

- Name pots by goal (“Japan Trip”) for motivation

- Set calendar reminders (e.g., “Save £200 on the 25th”)

✅ Best for:

- Big, specific goals (house deposit, car)

- Those who prefer manual control

Which Method Saves Fastest?

| Method | Avg. Monthly Savings* | Effort Level |

|---|---|---|

| Round-Ups | £30-£80 | Zero |

| AI Saving | £100-£300 | Low |

| Custom | Unlimited | High |

*Based on average Emma user data

Which Pot Fits Your Goal?

| Pot Type | Best For | Interest | Access | Protection |

|---|---|---|---|---|

| Easy Access | Emergency funds | Up to 3.98% AER | Instant | £85k FSCS |

| 45-Day Notice | Planned goals (e.g., house deposit) | Up to 4.45% AER | 45-day wait | £85k FSCS |

| Super Pot | Maximizing protection | Up to 4.01% AER | Next-day | £255k FSCS* |

*£85k per partner bank (up to 3 banks)

Why This Matters

- Ultimate flexibility: Save for specific goals in dedicated Spaces

- Shared financial goals: Family pots grow faster together

- Higher protection: Super Pot safeguards large savings (3x FSCS coverage)

Try it now: Update your app → Open any Space → Create your first cross-Space pot!

You may also like

Check out these related blog posts for more tips

© 2026 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.