FEATURED ARTICLE

Precision is Power: Introducing Subcategories for Ultimate Budgeting Control

Giuliano Fabbri

October 6, 2025 •4 min read

TABLE OF CONTENTS

The Problem with Vague Spending

Introducing Subcategories: Detail Without Chaos

How to Create & Manage Your Custom Subcategories

New Analytics: Seeing the Granular Detail

Advanced Search: Find Every Penny

Practical Applications: Find the Money You Need

Your Money, Fully Customised

For years, budgeting has been at the core of Emma's mission - and listening to your feedback is how we keep getting better. We heard one request loud and clear: "I need more detail! 'Transportation' isn't specific enough when I'm trying to decide between my car and the train."

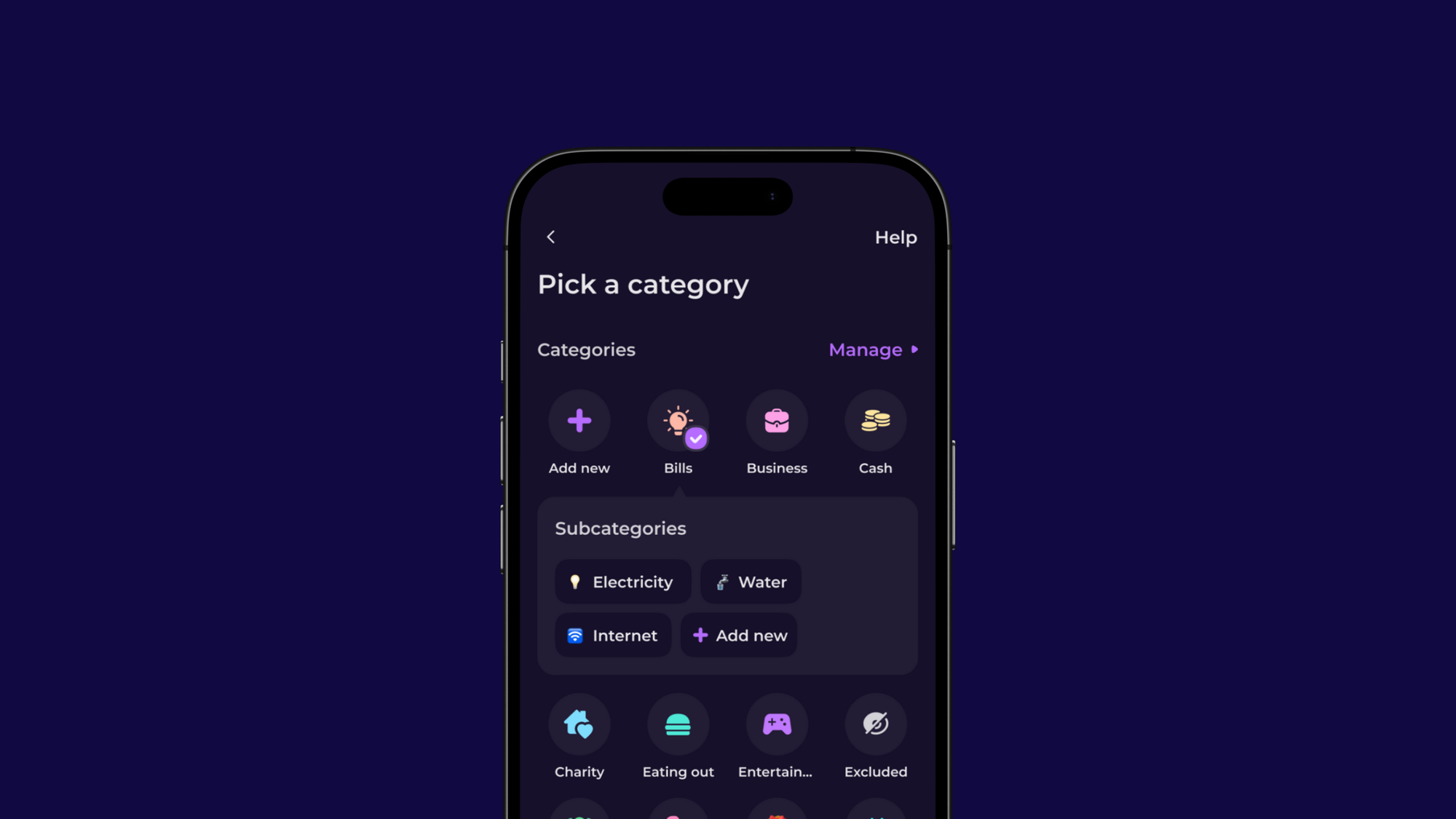

You heard it right: we've introduced a massive upgrade that allows you to create Subcategories for your expenses! This feature brings surgical precision to your financial tracking, ensuring every pound you spend is accounted for exactly where it belongs.

The Problem with Vague Spending

Budgeting works best when the data is actionable. If your 'Transportation' category shows you spent £400 last month, that figure is useless. Was that spent on:

- Fuel and Maintenance (a necessary, ongoing cost)?

- Train Tickets (a variable commuting cost)?

- Ubers and Taxis (a discretionary expense)?

Without this granularity, you can't identify where to cut back or optimize your money. That all changes today.

Introducing Subcategories: Detail Without Chaos

This massive upgrade builds upon our core mission of intuitive budgeting features, adding necessary detail without creating a confusing mess.

The system is simple: you can now nest categories within your main expense groups.

| Primary Category | Subcategories You Can Create |

| Transportation | Car (Fuel/Insurance), Public Transport, Taxis/Ubers |

| Groceries | Food Staples, Household Essentials (Cleaning/Toiletries), Pet Supplies, Alcohol/Treats |

| Eating Out | Takeaways/Delivery, Night Out (Restaurants), Office Lunch |

| Housing | Rent/Mortgage, Utilities (Gas/Electric), Service Charges/Ground Rent, Home Insurance |

This gives you the clarity to compare spending trends instantly. You can now see: "I spent £150 on Public Transport, but only £80 on my Car - I should switch back to driving."

How to Create & Manage Your Custom Subcategories

Creating and managing your new level of detail is seamless:

- Creating a New Subcategory: Simply click into the main (parent) category you wish to edit (e.g., "Groceries"). From there, select "Add Subcategory," name it (e.g., "Pet Supplies"). All transactions will automatically categorise based on the parent structure.

- Migrating Existing Custom Categories: If you have an existing custom category that you want to nest (e.g., your old "Takeaways" category), you can now select that category, choose to edit it, and assign a parent category (e.g., "Eating Out"). All past and future transactions will automatically adopt this new hierarchical structure.

New Analytics: Seeing the Granular Detail

We've designed the analytics flow to ensure your dashboard stays clean while the detailed information is readily available when you need it.

- Main Dashboard View (High-Level): Your main budget screen remains uncluttered. You will see your primary categories as usual (e.g., "Eating Out: £450"). This prevents information overload.

- Detail View (Granular Breakdown): Once you click into the "Entertainment" category, the new analytics view loads, showing the full breakdown: Movie, Music and Games.

This two-step process allows you to immediately pinpoint which sub-habit is driving up the total cost, enabling you to take quick, informed action.

Advanced Search: Find Every Penny

To make managing your detailed transactions easier, we've upgraded our search functionality:

- Filter by Parent & Sub: You can now search for transactions using the full category path. For example, searching for "Groceries: Pet Supplies" will instantly filter every transaction in that specific subcategory across all your accounts. This is perfect for end-of-month reviews or checking yearly spending trends on granular items.

Practical Applications: Find the Money You Need

Subcategories are powerful tools that let you optimise your spending habits:

- Mastering Commute Costs: Separate your 'Car - Fuel' from your 'Car - Insurance' and 'Car - Maintenance'. Suddenly, your high 'Transportation' budget breaks down into fixed and variable costs, revealing that you could save £50 a month by switching to a monthly train pass.

- Controlling 'Wants' vs. 'Needs': If your 'Food & Drink' category is too high, split it into 'Groceries (Needs)' and 'Takeaways/Delivery (Wants)'. This instantly visualises where your discretionary spending is going, making it easy to curb the costly habit of ordering in.

This level of precision is exactly what separates great budgeting from guesswork. You get the complete financial picture needed to achieve serious goals, whether it’s saving for a house deposit or getting debt-free.

Your Money, Fully Customised

We believe that your budgeting app should adapt to your financial life, not the other way around. Subcategories allow you to customise your finances to your heart's content, ensuring that your data is always accurate, easy to analyse, and actionable.

You may also like

Check out these related blog posts for more tips

© 2026 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.